nj property tax relief 2018

Property Tax Relief Programs. You must have applied and been eligible for a 2017 reimbursement.

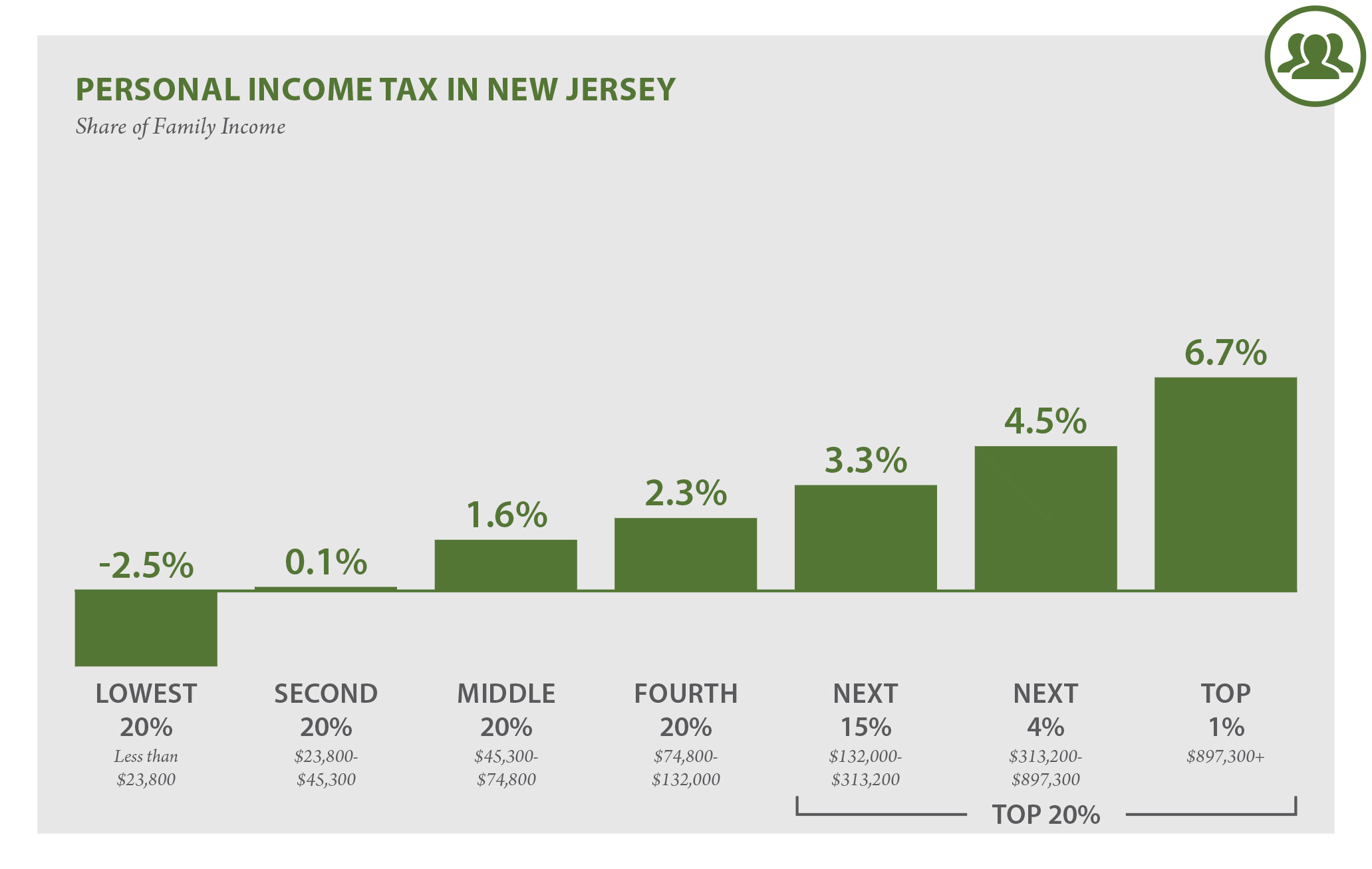

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Individual Income Tax Rate Reductions - Amends the Internal Revenue Code to establish as of tax year 2001 a 10 percent individual tax bracket for each filing status applicable to the first.

. Property Tax Relief Programs. You lived in New Jersey continuously since December 31. You were a New Jersey resident.

The New Jersey County Tax Boards Association established that all real property be assessed at 100 of market its value. The County Assessor determines each propertys the full and fair value as if it were to sell in fair and bona fide sale by private contract on the October 1 preceding the date the assessor completes the assessment list. Save Time - Sign up to auto draft your tax payments now.

Tax Rate Schedules 2020 and After Returns Tax Rate. Per the New Jersey Statutes Annotated 544-66 should the 10th fall on a weekend or a holiday the grace period extends to the next business day. When using the tax table use the correct column.

If you moved to the home for which you are filing a 2020 application between. NJ Income Tax Tax Rates Gross Income Tax. The County Assessor determines each propertys the full and fair value as if it were to sell in fair and bona fide sale by private contract on the October 1 preceding the date the assessor completes the assessment list.

Tax Table 2018 and After Returns Tax Table 2017 and Prior Returns If your New Jersey taxable income is less than 100000 you can use the New Jersey Tax Table or New Jersey Rate Schedules. To be eligible for 2021 property tax relief in New Jersey via the Homestead Benefit Program you must meet all the following requirements. Under the ANCHOR Property Tax Relief Program homeowners making up to 250000 per year are eligible to receive an average 700 rebate in FY2023 to offset property tax costs lowering the effective average property tax cost back to 2016 levels for many households that were previously ineligible for property tax relief.

Claim for Refund of Estimated Gross Income Tax Payment Required on the Sale of Real Property Located in New Jersey under the provisions of C55 PL 2004 Select A Year 2018. January 1 2018 and December 31 2018. Only for the August quarter you will receive a separate estimated tax bill mailed in June.

Conference report filed in House 05262001 Economic Growth and Tax Relief Reconciliation Act of 2001 - Title I. Pay Your Taxes Online. 2019 Tax Sale PDF 2018 Tax Sale PDF Second Quarter 2020 Property Tax Grace Period Extension PDF Quick Links.

1 12000 14000 for 2008 and thereafter of. Property Tax Bills Property tax bills are mailed once a year in September and contain four quarterly payment stubs. The New Jersey County Tax Boards Association established that all real property be assessed at 100 of market its value.

We will continue to monitor the situation and will. January 1 2019 and December. Taxes are due February 1 May 1 August 1 and November 1.

Box 240 Fairton NJ 08320. View All Links QuickLinks. We do not yet know if there will be a property tax rebate for 2018 as the credits are usually a few years behind.

Also renters making up to 100000 per year. 70 Fairton Gouldtown Road Bridgeton NJ 08302.

Where S My New Jersey State Tax Refund Taxact Blog

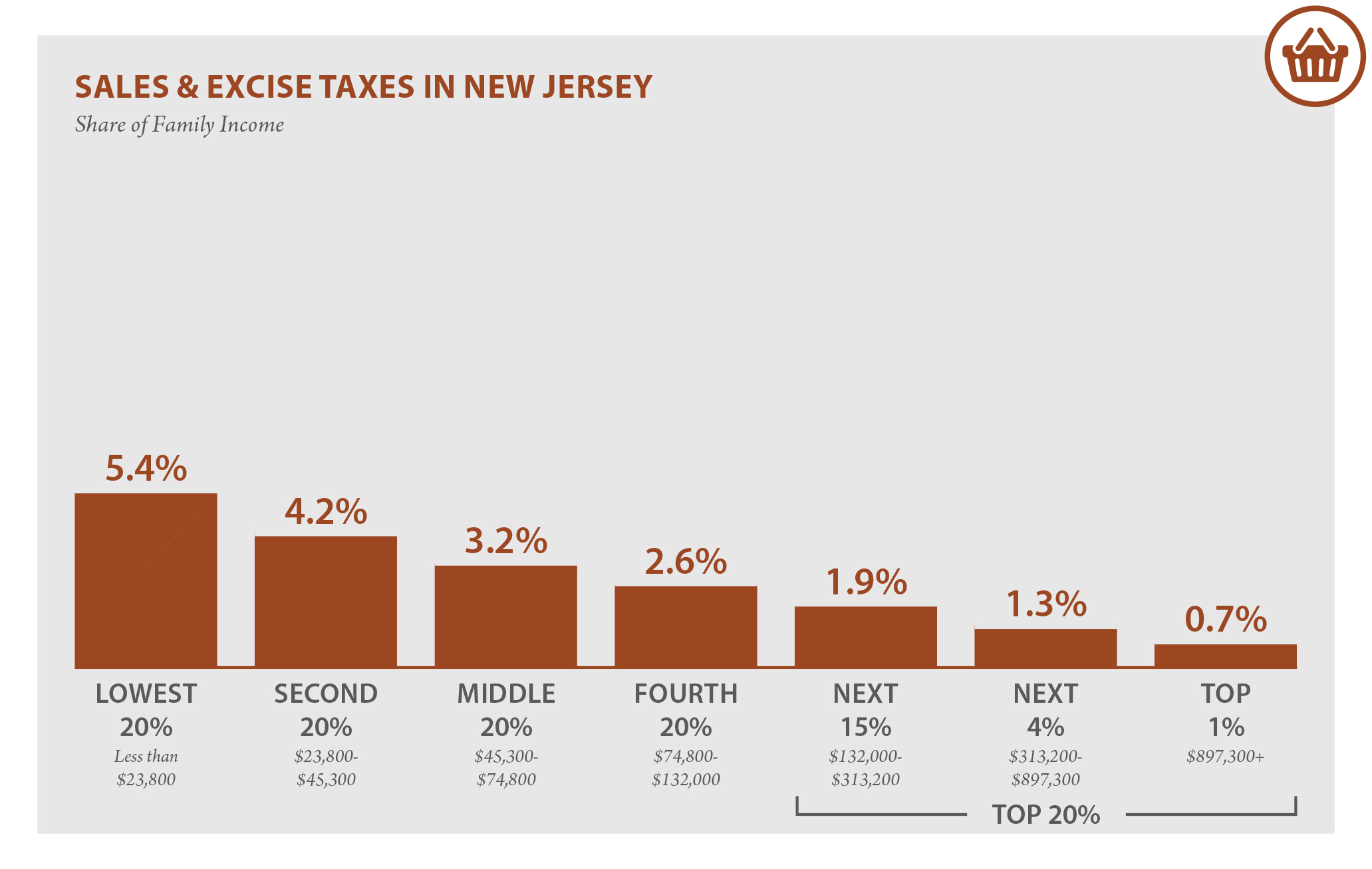

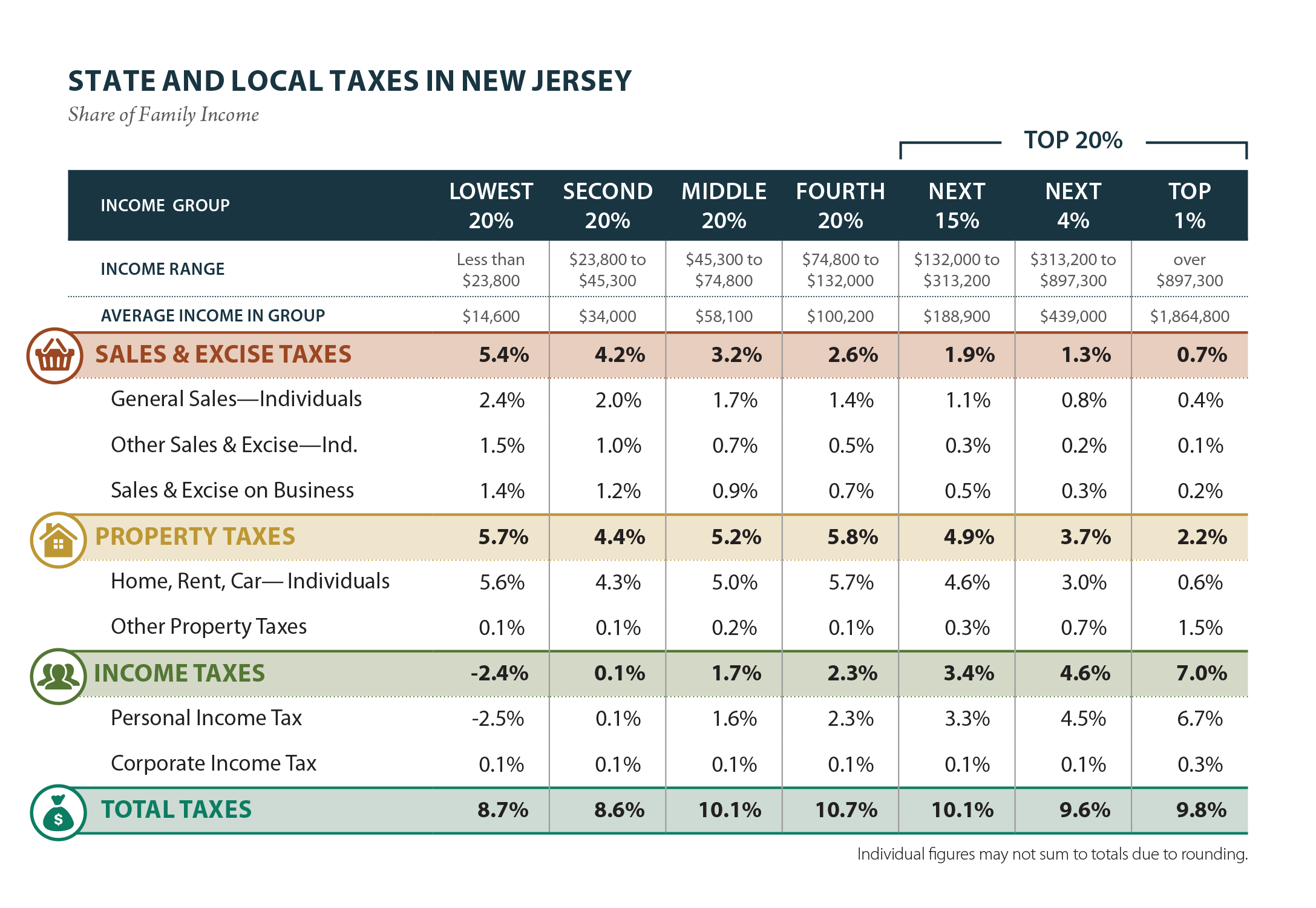

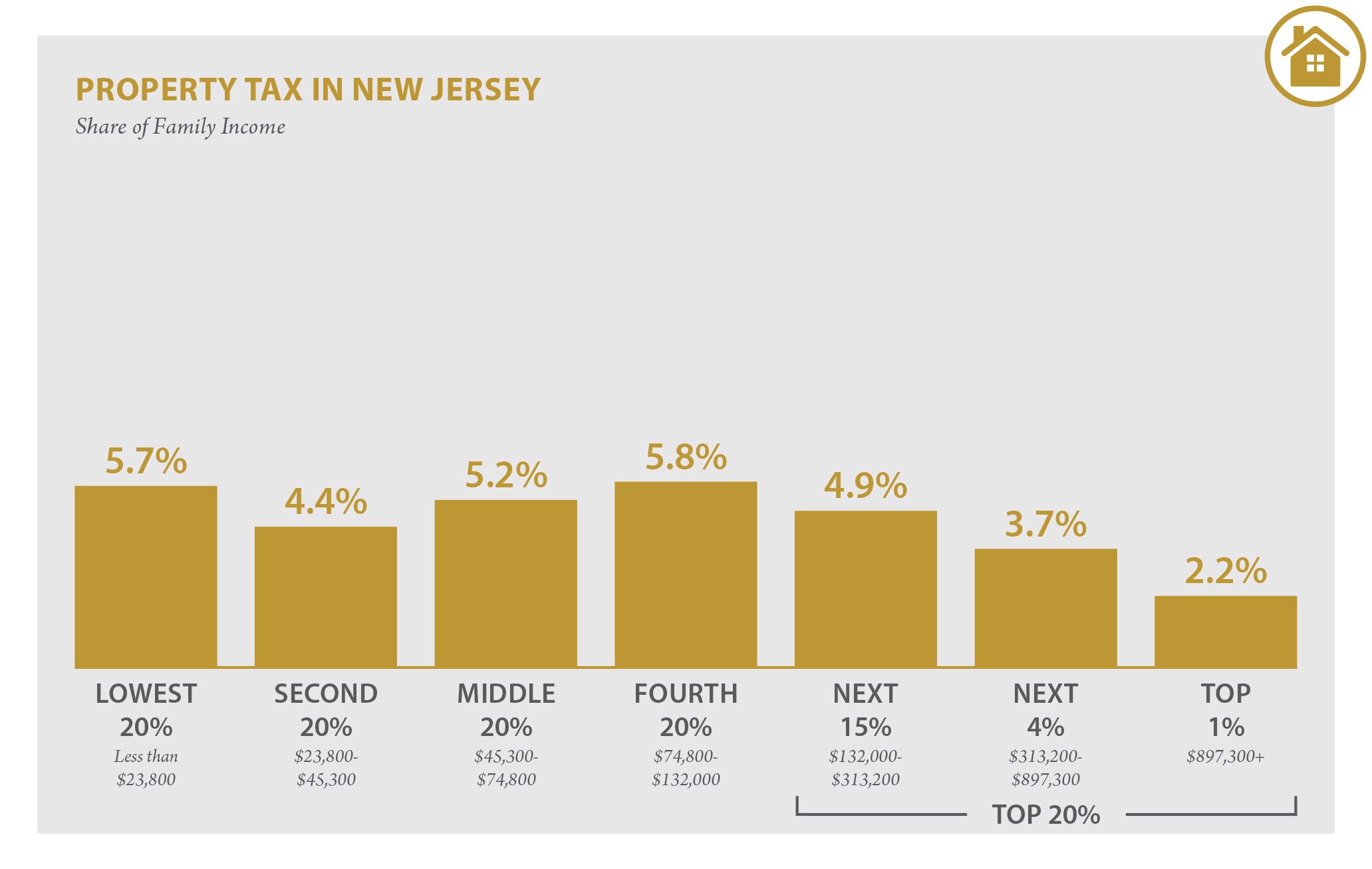

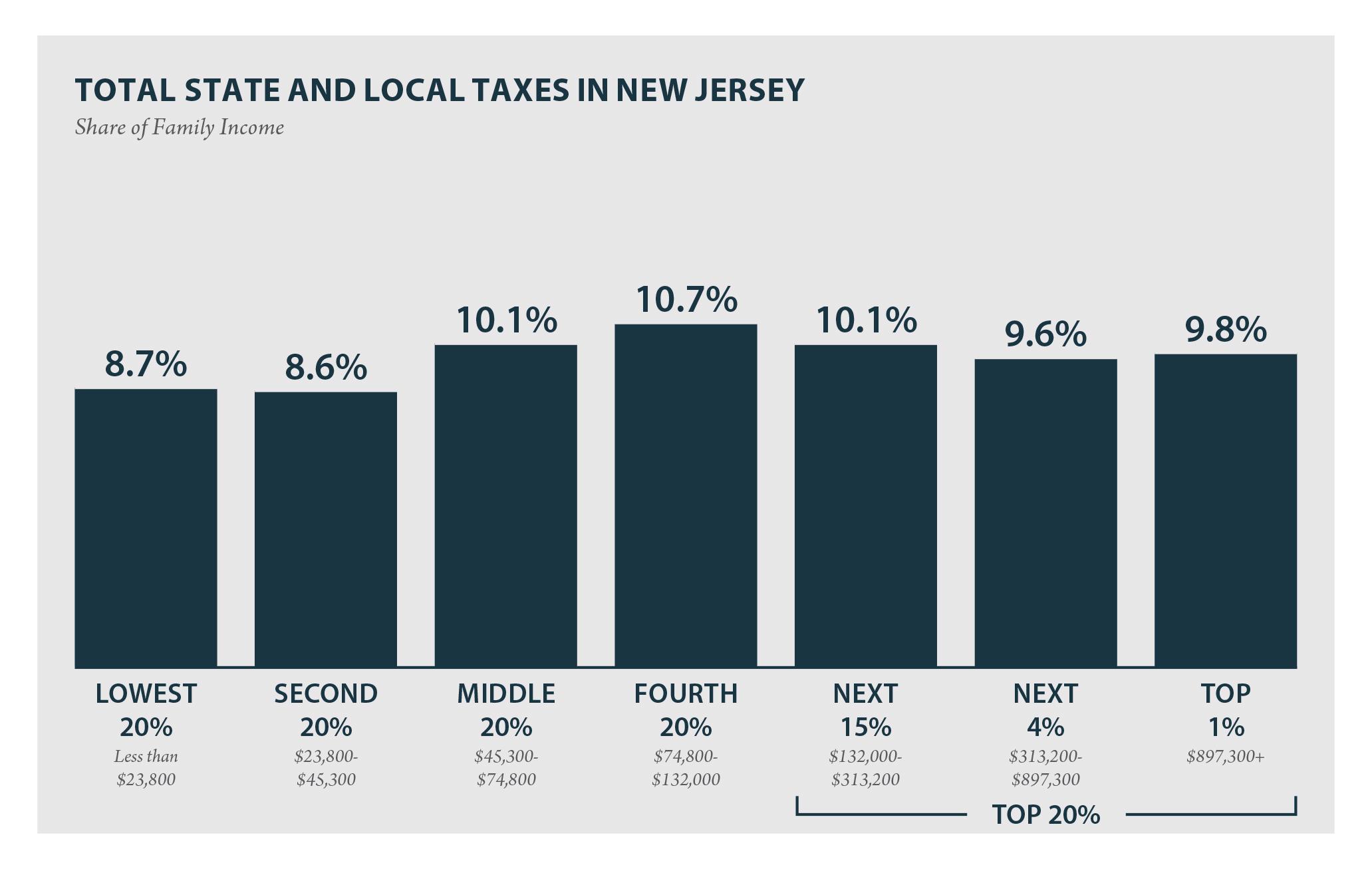

New Jersey Who Pays 6th Edition Itep

New Jersey Who Pays 6th Edition Itep

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Township Of Nutley New Jersey Property Tax Calculator

Nj Property Tax Relief Program Updates Access Wealth

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Township Of Nutley New Jersey Property Tax Calculator

The Top Ten Events In Somerset County Nj This Weekend March 30 April 1 2018 Joe Peters Somerset County Somerset County

Phil Murphy Agrees To Reduced Sales Tax In These 5 N J Cities Nj Com

New Jersey Who Pays 6th Edition Itep

Murphy Proposes 900m Anchor Property Tax Relief Program New Jersey Business Magazine

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A Great Selling House Just A Reminder Reminder

Property Tax Reduction Should You Hire An Expert Tax Reduction Property Tax Tax Consulting

New Jersey Who Pays 6th Edition Itep

New Jersey Who Pays 6th Edition Itep

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future